Growth in EBITDAaL and decrease in eCapex boost organic cash flow

The Group again confirms its financial objectives for 2022, a milestone towards the achievement of its 2023 commitments

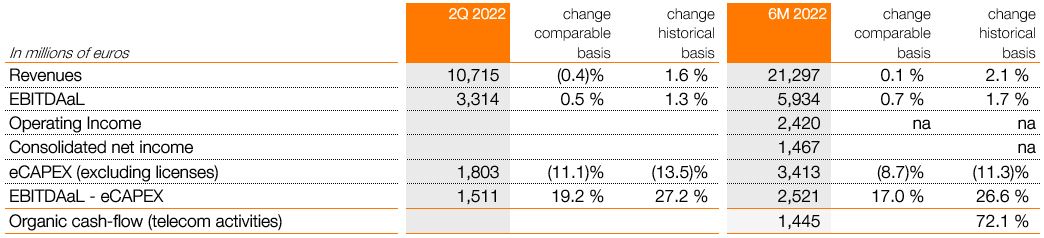

Revenues grew 0.1% in 1H 2022 and were slightly down by 0.4% in 2Q 2022, impacted by the underlying effect of fiber network co-financing received in 2Q 2021. In 2Q 2022:

- France (-2.7%) recorded solid growth in retail services of 1.4% (+3.4% excluding PSTN).

- Europe (-0.9%) improved (compared with -2% in 1Q 2022), due to strong growth in Poland (+3.4%) and Belgium (+4%) and the recovery under way in Spain (-4%).

- Africa & Middle East (+7.2%) continued to deliver strong growth.

- Enterprise recorded a decrease (-1.1%), as the structural decline in legacy Voice and Data activities outweighed the growth drivers of IT & integration services.

EBITDAaL increased 0.5% in 2Q 2022 (+4.5% excluding co-financing). The EBITDAaL margin from telecom activities grew for the second consecutive quarter.

EBITDAaL increased by 0.7% in 1H, driven by Africa & Middle East (+11.6%) and Europe (+0.6%), despite the steep decline in Enterprise (-25.3%). France, which decreased by 0.9% overall, recorded growth of 3.6% excluding co-financing. In line with our year-end targets, EBITDAaL growth is expected to accelerate in 2H, mainly due to the reversal of underlying effects (co-financing and the employee shareholding program).

Operating income was +2,420 million euros at 30 June 2022 (compared with an operating loss of -1,752 million euros on a historical basis at 30 June 2021, due to the effects of the goodwill impairment in Spain).

Consolidated net income was 1,467 million euros, up 4,071 million euros on a historical basis. Excluding the goodwill impairment in Spain, it would still be up 369 million euros.

eCAPEX decreased 11.1% in 2Q 2022. In 1H as a whole, eCapex reached 3,413 million euros, confirming the decrease, albeit of a lesser magnitude, expected for the year.

Organic cash flow from telecom activities grew strongly, reaching 1,445 million euros at 30 June 2022 (+605 million euros compared with 30 June 2021 on a historical basis).

The Group has again confirmed its financial objectives for 2022 , a milestone towards the achievement of its 2023 commitments:

- A 2.5% to 3% increase in EBITDAaL

- eCAPEX no greater than 7.4 billion euros

- Organic cash flow from telecom activities of at least 2.9 billion euros

- Ratio of net debt to EBITDAaL from telecom activities unchanged at around 2x in the medium term

Orange will make an interim dividend cash payment for 2022 of 0.30 euros on 7 December 2022.

A dividend of 0.70 euros per share for the 2022 fiscal year will be proposed to the 2023 Shareholders’ Meeting.

Commenting on the publication of these results, Christel Heydemann, Chief Executive Officer of the Orange group, said: “In an environment still marked by the health crisis, geopolitical uncertainty and the effects of inflation, Orange has once again proven its resilience in the first half of 2022 both in terms of commercial momentum and in respect of its main financial indicators.

I would above all like to give my thanks to the Group’s women and men, based across the world, as it is due to their daily commitment and their ongoing efforts that we have collectively achieved the results presented today.

This solid performance allows us to confirm our guidance for the current year, a milestone as we move towards the delivery of our 2023 commitments. It also allows us to prepare for the future with confidence and responsibility as we work on our next strategic plan, which will be unveiled at the beginning of 2023.

I’d particularly like to underline the resilience of our EBITDAaL which grew 0.5% in the quarter but was up 4.5% year on year excluding the comparative effect related to co-financing in 2021. This trend reflects the validity of our “more for more” commercial strategy by which we offer our customers an augmented connectivity experience while ensuring accessible offers for all.

In Spain in recent quarters we have felt the effects of extreme competition in the telecoms market and of an especially challenging economic environment. It is particularly satisfying to note improved customer satisfaction and a reduction in churn. Our retail market revenues and EBITDAaL are improving, and we’re on track for a return to growth in 2023. Moreover, the historic agreement we signed last week with MasMovil to combine our activities in a new joint venture gives us plenty of reason to believe in the growth potential of Spain.

In other markets the trend is similar. In France, fiber and 5G continue to be attractive to our customers and contribute to the stabilisation of our financial performance. Africa and Middle East maintained its momentum, with strong growth in EBITDAaL of 11.6% over the first half, a performance fuelled by growing demand for mobile data, the development of the Enterprise market and an increased appetite for fiber.

Our solid retail market performance in Europe and Africa and Middle East have compensated for the difficulties that have weighed on our Enterprise business. The turnaround of this segment is a priority for the Group and we are fully mobilised to take the actions necessary to return to a path of profitable growth in this sector.”

Unless otherwise stated, the changes presented in this press release are on a comparable basis.

Excluding pending external growth transactions