Good start to the year, strong momentum on “Lead the Future”

- Creation of MASORANGE, new leader in Spain

- Acceleration of revenue and EBITDAaL growth in the first quarter

- Confirmation of 2024 targets

MASORANGE, the 50:50 joint venture combining the Spanish operations of Orange and MASMOVIL[1] was created on 26 March 2024. The Group’s Spanish operations are deemed to be discontinued under IFRS 5 until closing and will subsequently be consolidated using the equity method in the Group’s financial statements. Historical data has been restated.

Commenting on these results, Christel Heydemann, Orange’s Chief Executive Officer, said:

“Orange has made a very good start to the year, marked by the completion of the deal with MASMOVIL to create MASORANGE, creating the leading operator in Spain in terms of customer numbers. This is a major step forward in the execution of the “Lead the Future” plan and for the Group’s development in Europe.

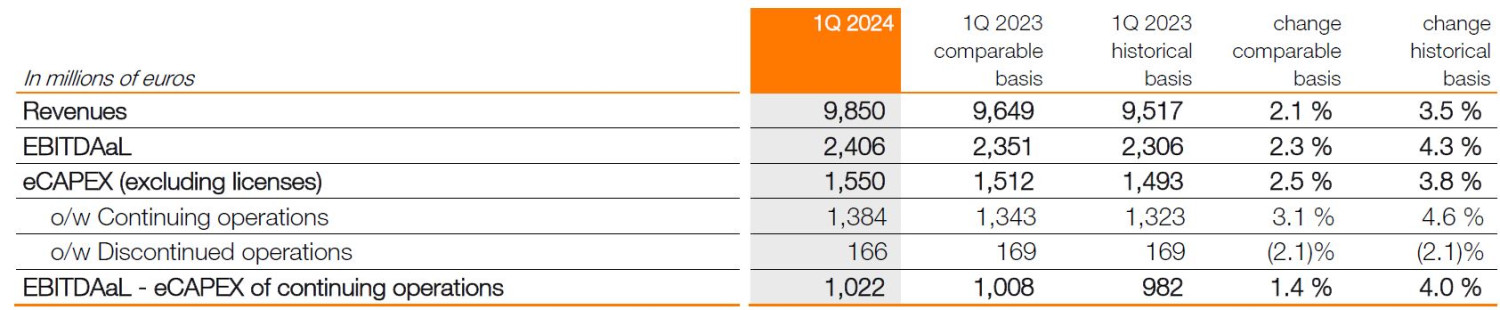

In the first quarter, Group revenues and EBITDAaL accelerated, rising 2.1% and 2.3% respectively, in line with this year’s objectives as set out in our strategic plan.

In France, revenue growth was driven by retail services, underpinned by a value-oriented strategy that delivered increases across all ARPOs.

In the B2B market, Orange Business revenues were stable while those of IT and Integration services, Orange Cyberdefense in particular, grew. Orange Business continues to execute its transformation plan with several important milestones achieved this quarter, notably the implementation of the cost reduction plan.

Driven by its robust growth drivers, the Africa & Middle East region maintained its strong momentum with double-digit revenue growth for the fourth consecutive quarter.

I would like to thank all our colleagues for their dedication and trust. Orange continues to evolve to be efficient across all its activities and be among the sector’s global leaders.”

Orange group revenues rose 2.1% compared with the first quarter of 2023[2] (+201 million euros) thanks to growth in retail services (+3.2% or +232 million euros) and a smaller decline in wholesale services (-4.1% or -62 million euros), mainly related to higher unbundling rates in France.

- Africa & Middle East is the main contributor to this growth, with revenues rising strongly (+11.1% or +185 million euros) lead by a robust performance in voice and double-digit increases in its four growth engines (+15.7% in mobile data, +20.6% in fixed broadband, +23.5% at Orange Money and +14.1% in B2B across all activities), and this despite the devaluation of the Egyptian pound.

- Revenues in France increased 0.8% (+35 million euros) thanks to the growth in retail services excluding PSTN[3] (+3.0%), in line with the “Lead the Future” target of growth between 2.0% and 4.0%, and to a smaller decline in wholesale (-4.2%) due to the higher unbundling rate applied from 1 January 2024.

- Europe declined (-2.0% or -35 million euros) due to a reduction in low-margin activities, offset partially by the continued growth of retail services excluding IT and Integration services (+0.9%).

- The slight decrease in Orange Business revenues (-0.3% or -6 million euros) was due to the decline in fixed voice revenues (-8.7% or -72 million euros), which was almost offset by accelerated growth in IT and Integration services revenues (+7.5% or +65 million euros), notably driven by Orange Cyberdefense (+15.3% or +39 million euros).

- In terms of commercial performance, the Group maintained its leadership position in convergence, with 9.1 million convergent customers (+1.9%), as well as its commercial momentum in mobile contracts and very high-speed fixed broadband accesses. Mobile services had 242.6 million accesses worldwide (+7.0%) including 90.7 million contracts (+12.3%). Fixed services had 39.2 million accesses worldwide (-3.2%) of which 13.3 million were very high-speed broadband accesses, an area that continued to show strong growth (+14.4%). Fixed narrowband accesses continued their decline (-13.2%).

The Group’s EBITDAaL was 2,406 million euros for the period ended 31 March 2024, an increase of 2.3% in line with the objective of slight growth in 2024. The EBITDAaL from telecom activities was to 2,440 million euros (+2.3%).

eCAPEX amounted to 1,384 million euros in the first quarter of 2024, excluding 166 million euros of CAPEX for Spain booked in the first quarter in the Group’s financial statements. eCAPEX rose 3.1% and eCAPEX for telecom activities as a percentage of revenues was 14.0%, reflecting the objective to maintain discipline in 2024. The number of households connectable to FTTH reached 56.2 million excluding Spain (+12.2%), and the FTTH customer base was 12.2 million (+15.4%).

The Group can therefore confirm its financial targets for 2024[4] :

- Low single-digit growth in EBITDAaL

- Discipline on eCAPEX

- Organic cash flow of at least 3.3 billion euros from telecom activities

- Net debt/EBITDAaL ratio of telecom activities unchanged at about 2x in the medium term

- Proposal to increase the 2024 dividend payable in 2025 to 0.75 euros per share, including an interim dividend of 0.30 euros in December 2024.

Changes in the asset portfolio

Impact of the creation of MASORANGE, the joint venture between Orange and MASMOVIL in Spain

The Group’s operations in Spain are deemed to be discontinued under IFRS 5 “Non-current Assets Held for Sale and Discontinued Operations” for the period from 1 January to 26 March 2024, and the historical data was restated in the same way.

As a result:

- the consolidated income statement presents continuing and discontinued operations separately. Orange’s net income and expenses in Spain are presented until 26 March 2024 in net income from discontinued operations, and the data published for previous years has been restated accordingly. Applied retroactively, the constituent parts of the newly published net income from continuing operations no longer include Orange’s net income and expenses in Spain, and the procedures for eliminating internal operating flows have been reviewed;

- the previously published consolidated statement of financial position and consolidated cash flow statement remain unchanged and include Orange’s assets/liabilities and cash flows in Spain.

Since 26 March 2024, the investment in the joint venture has been consolidated using the equity method in the Group’s Consolidated Financial Statements.

The Board of Directors of Orange SA met on 23 April 2024 and reviewed the consolidated financial results at 31 March 2024.

More detailed information on the Group’s financial results and performance indicators is available on the Orange website www.orange.com/en/consolidated-results.

[1] Excluding TOTEM Spain

[2] Unless otherwise stated, percentage changes are on a year-on-year basis, calculated against Q1 2023 on a comparable basis.

[3] Public Switched Telephone Network

[4] These targets are on a comparable basis and do not take into account mergers and acquisitions not yet finalized. They exclude the contribution of Orange Spain.